DAS KAPITAL: ‘Currency Wars’, The World Is On The Verge Of An Epochal Monetary Revolution – By Tuomas Malinen

SM

Source – gnseconomics.com

- “…During the past 100 years central banks have assumed a role in the economy that they were never meant to have. They attempt to direct the economy through interest rate manipulation and now they are even trying to control the capital markets through asset purchase programs, or QE. Next, they are likely to aim for global economic dominance through the issuance of national digital currencies, or CBDCs. Freely issued cryptocurrencies can be seen as a countering force to this”

Currency Wars: The World Is On The Verge Of An Epochal Monetary Revolution

By Tuomas Malinen

Currency Wars – Special report on the future of the monetary system

- The world economy may be on the verge of the largest upheaval of its monetary system in a century.

- The competition between freely-created cryptocurrencies and centrally-controlled central bank digital currencies is likely to dominate the economic debate in coming years.

- In this special report we analyze and outline the future of the monetary system, including the “currency wars” likely just ahead of us.

The world is heading to what is likely to be the biggest upheaval of its current monetary system since the First World War and the collapse of the classical gold standard. In this special report, we analyze the scenarios the monetary system is likely to follow. More precisely, we concentrate on the two opposing and competing monetary developments: freely created cryptocurrencies and the centrally controlled central bank digital currencies, or CBDCs. Their “competition” is likely to bring a major upheaval in the monetary system not seen at least for a century.

This is naturally all closely linked to the history of central banking. We have written extensively about central banks and their history. To briefly summarize the discussion, during the past 100 years central banks have assumed a role in the economy that they were never meant to have. They attempt to direct the economy through interest rate manipulation and now they are even trying to control the capital markets through asset purchase programs, or QE. Next, they are likely to aim for global economic dominance through the issuance of national digital currencies, or CBDCs. Freely issued cryptocurrencies can be seen as a countering force to this. Which system will rise to dominate will dictate the future of not just the banking system but also our societies more broadly. Thus, we may actually be on the verge of the biggest upheaval of our economic system since the invention of money!

We start with the history of money and then move into explaining cryptocurrencies and CBDCs. Then we summarize our analysis and move into quarterly forecasts.

The (long) history of money

Current archaeological research finds that the measurement of economic interactions—also known as “accounting”—even predates writing. The clay tablets discovered at the birthplace of Mesopotamia, the Temple of Uruk, were used as an accounting tool for commodities and also for human labor around 3100 B.C.The foundations of banking practices were developed in Ancient Greece, in the harbor city of Piraeus, where the local bankers, or trapezitai, took deposits and provided loans. The idea of “monetary value” also came to be in Ancient Greece. While borrowing and lending in commodities followed banking practices already observed in Mesopotamia, the concept that everything, including commodities, services, human labor, and so on had economic worth and could be priced using a unified measure of value, was created in Ancient Greece. This development also made modern banking practices possible.

Still, the first known banks that truly resembled their modern counterparts operated in Imperial Rome. It has actually been said that Rome’s financial system was so sophisticated that it was eventually surpassed only by the banking sector created during the Industrial Revolution.

While simple merchant banks, usually in the service of the rulers, appeared in Europe in the 14th century, the first modern banks and payment systems were created in the 16th century. They arose from merchant fairs where commodity trades were settled.7 By 1555, the merchant fair of Lyons had become a clearinghouse for credit and debit balances of merchant houses across the continent. The merchants realized that the trustworthiness of well-known international merchants could be used to circulate their promissory notes (a legal pledge to pay back at a future time) to not so well-known local merchants to create a credit system, where bilateral promises between local and international merchants were paid out as liquid liabilities. These could then easily be assigned from creditor to creditor and, in essence, create money and credit. There, basically, the fractional banking system was born.

In the fractional banking system only a small portion—a “fraction”—of the liabilities, like deposits, and assets, like loans, are covered by the reserves or the capital of a bank. A bank is an exceptional entity in the sense that while, for example, the output of a tractor company is tractors, the output of a bank is debt. This debt is given out as an IOU or, more precisely, as a bank deposit. Basically, the bank provides an assurance that whatever sum you may deposit there, you can get it back whenever you want—a contractual warranty of sorts.

Money creation by banks, and its stability

In modern economies, most money creation occurs in commercial banks. When a person or a company receives a loan, a bank creates a double entry to its balance sheet. One adds the loan to the asset side of the borrower and the other credits the deposits of the borrower’s account. When the loan is paid back, that money is “destroyed”, and the double-entry in the bank’s bookkeeping disappears. There is a natural restriction of money creation by banks. If a bank makes too many risky loans, loan defaults can lead to substantial losses and to insolvency, bankrupting the bank. Simple accounting rules and rules of the market economy thus tend to hold money creation at bay, but it is also restricted through regulation by the government and by reserve requirements issued by the central bank. So, banks need to obey a budgetary limit, which is partly set by economic agents, and partly by the central bank through interest rate decisions and reserve requirements.A crucial feature of a money is stability. When everything is valued in a specific currency, its value needs to be stable for people to be willing to accept, use, and hold it. Hyperinflation, where money loses over 50% of its purchasing power in a month, is driven by mistrust by the public towards a currency. Hyperinflations are caused by the combination of excess money creation and diminishing productive capacity. Ominously, these prerequisites for hyperinflation are currently close to being met.

Free banking, and its limits

History illustrates other periods when the value of money has not been stable. The U.S. experienced an era of “free” or “wildcat” banking between 1837 and 1863. During the “free banking” era, capital alone was required to start a bank, without the approval of state legislatures.

There were three other conditions:

The main problem of the ‘wildcat banking era’ was that bank notes did not trade at par across the country. Distance was a factor in determining discounts. For example, some notes issued by a bank in the South did not circulate in the East and because the issuing bank was not known, the discount was higher. The market for banknotes, where brokers traded notes, determined the discounts.1) state or federal bonds were required on deposit as collateral for notes issued by the bank

2) the banks were required to redeem the note on demand in gold or silver specie, and

3) banks were limited liability companies.

When a note was presented in payment for goods or services, a shopkeeper would need to identify the name of the issuer in a small newspaper called a “banknote detector”, which would specify the market discount on the bank’s note. Approximately 1,500 bank notes were in circulation at varying discounts from par. The highest reported discount was 25%.

The requirements for money

During the U.S. Civil War, the National Bank Act was legislated which created national banks and national bank notes, i.e., money issued by the federal government. This stabilized the value of bank notes across the U.S. However, while the Act was not passed to create an efficient medium of exchange for the system, but rather to finance the war, it did recognize two important provisions:

So, the “free banking” era ultimately proved that bank notes need to be backed by collateral and only money backed by a government will be trusted and traded ‘at par’, that is, it will be accepted in transactions at full face value.1) Money needs to be backed by collateral that is safe.

2) Only government is able to provide completely riskless collateral.

The monetary revolution ahead

Now, we are on the verge of similar massive upheaval of the monetary system from two opposing directions: freely created cryptocurrencies and the digital currencies of central banks.

Cryptocurrencies

Cryptocurrencies consist of decentralized digital assets that are secure and semi-anonymous i.e., all transactions are recorded in a ledger, although parties’ identities are hidden. Blockchain technology is used to ensure the integrity of the data. Cryptocurrencies are generally not backed by any institution or organization. They have no fundamental or intrinsic value, but may have, by design, a high degree of scarcity. The algorithm creating the cryptocurrency may also try to stabilize the value of the cryptocurrency relative to a fiat currency issued by a central bank and government. These so-called “stablecoins” include XRP, which acts as an intermediary between currencies of networks, and Tether, which is (supposedly) pegged 1-to-1 to the U.S. dollar. Cryptocurrencies may also be backed by assets, like real estate, or commodities, like gold or oil.

Money should act as store of value, a means of transaction, and a unit of account. However, the dollar value of traditional cryptocurrencies, like Bitcoin, are extremely volatile and can change tens of percent in a day. It is also uncertain how one measures the value of one cryptocurrency against another cryptocurrency such as happens in a normal currency “cross-rate”. Cryptocurrencies have neither fundamental value nor are they backed by anything, unless through some asset or commodity as mentioned above. Such “managed coin”, on the other hand, raises a question: is the asset-backed cryptocurrency anything more than a medium between assets and commodities? Valuing something in a cryptocurrency obviously can work, but that “price” could change fast when measured in fiat money, since the market prices of cryptocurrencies are hugely volatile. Cryptocurrencies also have limited use as a medium of exchange. They are not accepted as a payment by most businesses—indeed, companies that accept cryptocurrencies are the rare exception, not the rule. Additionally, the fact that purchases in bitcoin are either considered a form of “barter” or a regular commodity trade requiring tax reporting of all capital gains and losses resulting from the transaction makes their use even more problematic. Again, stable purchasing power and wider acceptance would be needed. Currently, most cryptocurrencies look more like a purely speculative asset than a currency.

However, there are legitimate reasons for the rising popularity of cryptocurrencies besides those of intense speculation based on the hopes of rising dollar prices. They may fill some needs. They offer secure online payments. The semi-anonymous nature of transactions is preferred by some.20 Digital assets are extremely portable and not confined by political borders. Government controls are still being designed. Technically you should pay taxes on cryptocurrency sales, but enforcement is uncertain—at least for now. Lastly, cryptocurrencies may function as an inflation hedge, although their wild price swings appear to happen for different reasons and any long-term correlations with various inflation indices are unclear.

The above-mentioned factors help to explain why cryptocurrencies are likely to face challenges in the future. Central banks want to have control over money. Governments want their tax money. Thus, an anarchistic, semi-anonymous, portable, digital currency is a threat that will be “fixed” when it is deemed serious enough. One neat argument against cryptocurrency in the current climate is that blockchain system and cryptocurrency “mining” needs enormous amounts of energy. Another is that it is used for criminal purposes, such as ransomware and money-laundering.

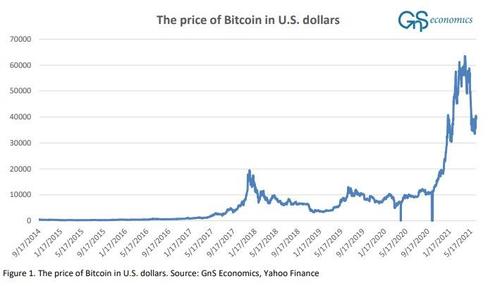

The popularity of cryptocurrencies has risen, and their prices have skyrocketed in the past few years. Case in point, see price of Bitcoin in Figure 1.

Investors are looking for alternatives, an easy return, or simply want to invest in a new technology, reminiscent of the “dot-com” bubble. Despite the name, cryptocurrencies are not themselves real legal currencies, or even money for that matter. A more fitting description would be “a blockchain-based, speculative asset class”. By buying non-asset-backed cryptocurrencies, you invest in a relatively new asset class with zero intrinsic value. So, the question should rather be: what it is that you are actually buying? While the technology itself is promising and even “revolutionary”, its application alone does not add a tremendous amount of value. Nobody owns blockchain technology and anyone can make a new cryptocurrency, and many have done just that. While artificial scarcity is induced by design for particular cryptocurrencies, there is no limit to the potential number of different cryptocurrencies. As a result, new competing cryptocurrencies are popping up with no end in sight. Which—if any— will survive in the medium or long run?

Central bank digital currencies

Central bank money is at the core of modern financial systems. It is comprised of physical cash in circulation and central bank reserves—the deposits of financial institutions at the central bank. A central bank digital currency, or CBDC, would create another layer of central bank money. In its strictest form, a CBDC is a digital payment instrument, which is denominated in the national unit of account, or currency, which is also a direct liability of the central bank.

Essentially a CBDC can take two forms. It can be a central bank issued (retail CBDC) digital currency or a central bank-backed digital currency (a ‘synthetic’ CBDC). A CBDC is ‘synthetic’, when it is backed by deposits (reserves) at the central bank.22 Another name for this is wholesale CBDC. A retail CBDC is in question, when it is widely acceptable digital form of fiat money, which can or cannot act as a legal tender.

However, one can argue that the ‘synthetic’ CBDC (sCBDC) is not an actual CBDC. The basic mechanism of a sCBDC is when private sector payment service providers issue liabilities matched by funds (reserves) held at the central bank.23 The private issuers of digital currencies would act as intermediaries between the central bank and the end users: consumers and firms. Regardless of whether the liabilities of the providers would be fully matched by funds held at the central bank, the end users would not hold a claim on the central bank. This means that these liabilities, and thus the digital currency would not constitute a ‘pure’ CBDC. Essentially, sCBDCs would be “narrow-bank” money, where all deposits would be 100% guaranteed by central bank money (reserves).

However, if such a system would be set up, it would affect the banking system in a detrimental way. First, fractional reserve banks, where banks hold only fraction of their liabilities and assets are covered by capital or CB reserves, would come under pressure. 24 Banks would be likely to lose some customers, pushing them to seek more wholesale funding, such as funding from commercial credit markets like state and local municipalities and brokered deposits. Banks could be forced to raise interest rates on deposits, which would reduce their profits. The biggest problems would arise in a banking crisis. Because sCBDCs, or CBDC ‘e-money’ holders would be fully covered by central bank reserves, unlike fractional reserve banks, the existence of sCBDCs could easily worsen a potential run on banks thus making the banking crisis worse.

A pure CBDC could be account- or token-based. The former (an intangible property) would involve the transfer of a claim between accounts and it would resemble a bank account transfer with the exception that accounts would be within the central bank. In the latter there would be a transfer of a token between wallets. Settling transactions using a token-CBDC (a tangible property) would require external verification of the tokens, which would imply that anonymity, like with transfers in cash, could not be guaranteed.

A retail CBDC would alter the banking system in a radical way. It is the role of a central bank to monitor and regulate banks and to act as a ‘lender of last resort’ during a banking crisis. With the issuance of a CBDC, the central bank would also become the competitor of commercial banks. It’s rather obvious that this would corrupt the whole financial system. Commercial banks would be forced to compete the more secure CBDC with higher interest rates and even if the CBDC would be non-interest bearing, it would still offer safety especially in a zero or negative interest rate environment. Banks would thus compete against the CBDC by issuing higher deposit rates, while they would at the mercy of central bankers concerning regulation and guidelines. Questions can be raised whether central bankers could act in an even-handed way in this setup.

However, problems would magnify in a banking crisis. If the central bank has the backing of a fiscal authority, it can provide banking services— deposits—backed by the taxing power of a government. It’s obvious that in this situation, the central bank will offer superior deposit safety in a banking crisis. Thus, if consumers believe that a commercial bank run is imminent, all depositors will move their deposits to the safety of a central bank. Such a flight from commercial banks to the safety of the CBDC could be countered only with strict deposit limits to the central bank. It’s questionable whether such limits could be maintained in a banking crisis as the crisis would, almost certainly, create a political pressure to open the balance sheet of the central bank with a CBDC to all. This would lead to a situation where the banking system would consist of just one bank, the central bank.

If a CBDC dominates the monetary realm of a country, the central bank would come under heavy political and economic pressure to use its profits and its ability to divert lending towards politically desirable ends, such as “green” initiatives, social, gender or racial equality, universal basic income, or even towards supporters of “politically acceptable” political parties. This would lead to a deluge of unprofitable investments and the utter corruption of the banking system. Moreover, as central banks are only ‘quasi-independent’, the banking system would essentially become controlled by the government. We have detailed the massive risks to economic and civil freedoms this would entail in QReview 12/2020.

The future of money, cryptos and central banking

The main problem of many cryptocurrencies is that they do not fulfill the requirements of money. For example, Bitcoin’s “price” is far too volatile to serve as a currency of any nation. It also not backed by any collateral. This is why the global bank standard setter, the Basel Committee for Banking Supervisor, issued a statement that banks should apply 1250% risk weight to Bitcoin.28 This means that using the minimal capital requirement of 8%, the banks would need to fully collateralize any Bitcoin holdings (for instance, if a bank holds $100 in Bitcoin exposure, it must have $100 worth of good-quality collateral to cover it). As shown by the historical example of ‘wildcat banking’ in the U.S., a crucial feature of a reliable means of payment is value, more precisely the fact that claims between interacting parties can be assumed to be fixed.29 This guarantees redemption at a pre-established face value denominated in the unit of account, the currency. One simply cannot envision a monetary system where the currency in question could plummet by over 50% in a matter of days. Money is used in daily transactions by corporations and people. Just imagine the apprehension and mistrust among the holders of a currency if they could not know what it’s purchasing power would be tomorrow and that it could be manipulated by the decisions, and Tweets, of powerful public figures.30 Quite simply, a monetary system cannot be based on any currency whose value and thus purchasing power fluctuates wildly on a daily basis.The main problem of Bitcoin, as well as other cryptos of its kind, is that their number of units is based on some pre-ordered rate of increase, which is essentially driving the volatility in price, as the supply of the coins do not respond to fluctuations in demand. The number of Bitcoins in circulation is directly related to the computational power used to ‘mine’ the code that create the coins. It does not have any connection to the real and financial economy, which is the second main requirement of a currency. The amount of currency in circulation needs to follow the economic activity.

This is effectively what the money and credit creation does through the banking sector. Banks lend money based on their assessment of the economic situation and of the ability of a given borrower to repay the loan based in part on the expected profitability of the investment the money is used for. When the economy heads into a recession, banks curb lending and when economic growth accelerates, banks increase lending. While this increases the fluctuations in the economy, the amount of money in circulation tends to follow the volume of economic activity. Or it would, if there weren’t central banks actively trying to manipulate money and credit creation by setting interest rates and through QE.

All this is not to say we could not have a cryptocurrency, based on the block-chain technology, that could not be used as a basis for a monetary system. If its creation via “mining” was, for example, somehow tied to the performance of the economy, this could ease price fluctuations making the cryptocurrency more stable and thus more fit to serve as money. The 1-to-1 pegged cryptocurrencies are an example of this. However, none of the current offerings in the cryptocurrency system have been ‘battle-tested’ in harsh economic conditions, for example during a banking crisis.

The problems with CBDCs are almost equally serious, but they ‘attack’ the banking system from another angle: safety. Essentially, modern economies need fractional reserve banking because the amount of money and credit in circulation needs to match economic activity. When banks issue loans, and create money, based on their business model (profit for risk), money enters into the economy in a productive manner. This naturally does not save the system from misuse or ‘moral hazard’, but those need to be purged from the banking system through combination of regulation and allowing banks to fail.

Issuance of CBDCs would corrupt the banking system, by making the central bank a competitor of those it regulates and guards—commercial banks. It would expose the banking system to catastrophic runs and, in the worst case, turn the monetary system into a government-controlled dystopia.

The solution could be an unforced merger or cooperation between commercial banks and the cryptocurrency-space. Cryptos offer many advantages, like the easy transfer of money between countries, which could be incorporated into the fabric of the modern financial system to make it more effective. It should be clear, however, that monetary systems need to be based, at least for the foreseeable future, on nationally issued currencies and fractional reserve banking. The role of central banks, on the other hand, should be significantly diminished, as they now dominate the financial markets and the economy. This is not what central banks were meant to do, and centrally run economies tend to lead to diminished or even negative productivity growth, inflation and falling standards of living. The issuance of CBDCs would be the final step down this perilous road. Cryptocurrencies are likely to have a major role in countering this.

Conclusions

The world is on the verge of a monetary revolution. Will it be driven by cryptocurrencies, or will the world be overtaken by central bank digital currencies?There have been many misconceptions about money in the past, and there continue to be such now. Money is essentially a common agreement to use an easily created medium of exchange in commercial transactions. Trust is an essential part of this. The purchasing power of money needs to be as stable as possible. Depreciation in the purchasing power of money has broken trust in many currencies in the past, in some cases leading to substitution where the failing currency of one country has been replaced by the currency of another country (in recent years, often the U.S. dollar). In the worst cases, the excessive issuance of currency has led to hyperinflation, where the purchasing power of money suddenly crashes.

“First-generation” cryptocurrencies, like Bitcoin, suffer from mortal deficiencies, including volatile price fluctuations, lack of utility, and no intrinsic value. Asset-backed cryptocurrencies could act as some sort of a medium of exchange, but they are either tied to fiat money issued by governments, like the U.S. dollar, or to some commodity, like gold or oil. Alas, they do not respond to the demands of the economy in the same way money and credit created by commercial banks does.

Money creation in commercial banks occurs through lending. In this way money enters the economy in a productive manner, i.e., through investment by borrowers. This is not to say that all bank lending would necessarily be profitable or productive, but even failed investments are needed to distinguish profitable ideas and projects from unprofitable ones. Bank lending is the correct way for the new money to enter the circulation of the economy. For the past century, central banks have made a mockery out of this process through monetary policies and the manipulation of interest rates.

The obvious failures of central bank policies are the biggest reason why CBDCs would threaten the economic fabric of societies. There is no such thing as “higher knowledge” in central banks, or in any institution for that matter, to help them to guide the economy efficiently. The more power a group of bureaucrats, or economists, have on the economy, the more politically and economically distorted it becomes, with dire consequences for social stability and cohesion. Flawed ideologies, failures of logic, and moral hazard always eventually affect human behavior and this is why political or economic control in a given society should never be entrusted to a “select few”.

https://gnseconomics.com/home/

https://rielpolitik.com/2021/07/07/das-kapital-currency-wars-the-world-is-on-the-verge-of-an-epochal-monetary-revolution-by-tuomas-malinen/

Thanks to: https://rielpolitik.com

Sat Mar 23, 2024 11:33 pm by globalturbo

Sat Mar 23, 2024 11:33 pm by globalturbo