Central Banks are out of Ammo with no Choice but to let their Currencies Burn

And Just Like That, The Tight Money Era Is Over

by John RubinoAt the beginning of last week, everyone expected central banks to “tighten until something breaks”. By the end of the week it was clear that they’d already broken everything.

Two middling US banks imploded, European mega-bank Credit Suisse finally died a well-justified death, and “who’s next?” speculation ran wild. And just like that, the era of tight money ended.

Now the world’s monetary authorities have broadened the definition of “systemic risk” to cover pretty much anything. FDIC insurance has been extended to every bank account of any size. Credit Suisse is being bought for pennies on the dollar by rival Swiss giant UBS. And according to Bloomberg,

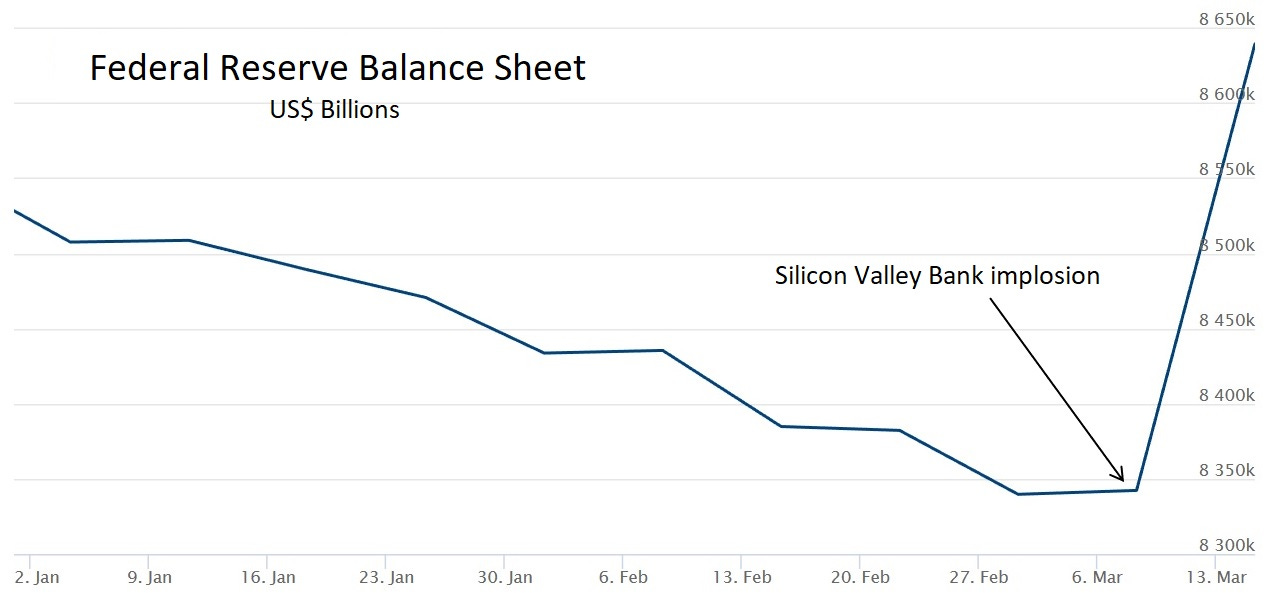

The Fed’s balance sheet — a measure of how much currency it creates and dumps into the economy — had been shrinking, which is to say the US money supply had been contracting. Now it’s soaring, up $300 billion in a matter of days.The Federal Reserve and five other central banks announced coordinated action on Sunday to boost liquidity in U.S. dollar swap arrangements, the latest effort by policymakers to ease growing strains in the global financial system.

Central banks involved in the dollar swaps will “increase the frequency of seven-day maturity operations from weekly to daily,” the Fed said in a statement coordinated with the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, and the Swiss National Bank.

The piecemeal, fingers-in-the-dike character of this response can be explained in one of two ways: Either the morons running the global financial system were completely blindsided because they actually thought rising interest rates and a falling money supply would slow inflation without unintended consequences, despite a century of contrary experience. Or the evil geniuses running the global financial system have engineered a multi-faceted crisis as an excuse to assume total control.

I’m agnostic on the above, but in either case, it seems clear that the world’s governments won’t be able to stop conditions from deteriorating. Consider:

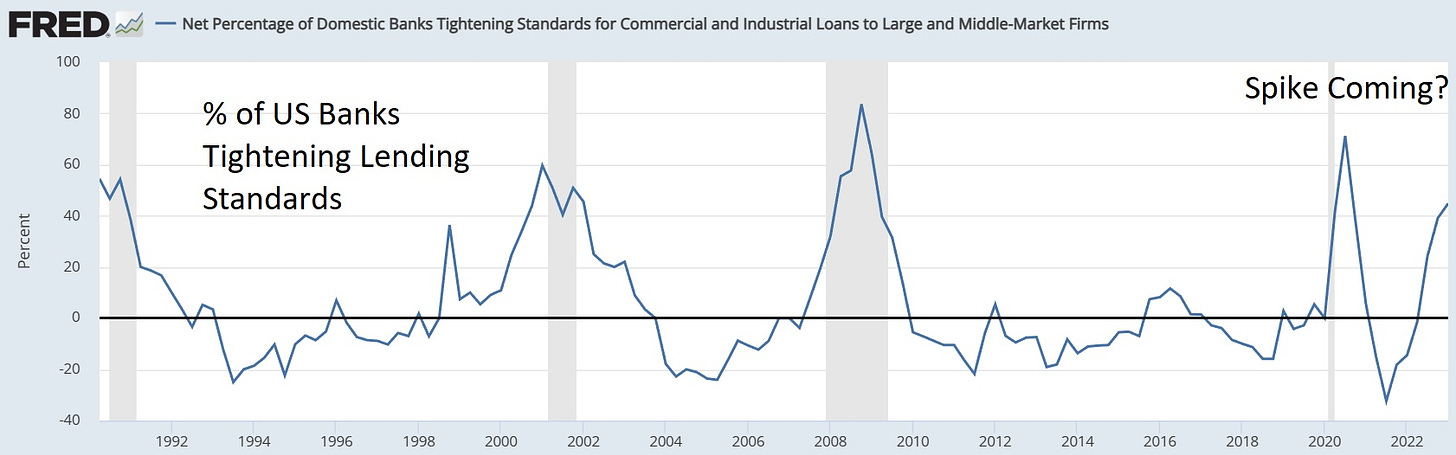

Lenders were already scared. Now they’re terrified

Banks were already tightening credit standards before last week’s flash crisis. Now virtually all of them will stop lending to any but their strongest clients. A year from now the updated version of this chart will show a spike to record high tightening levels.

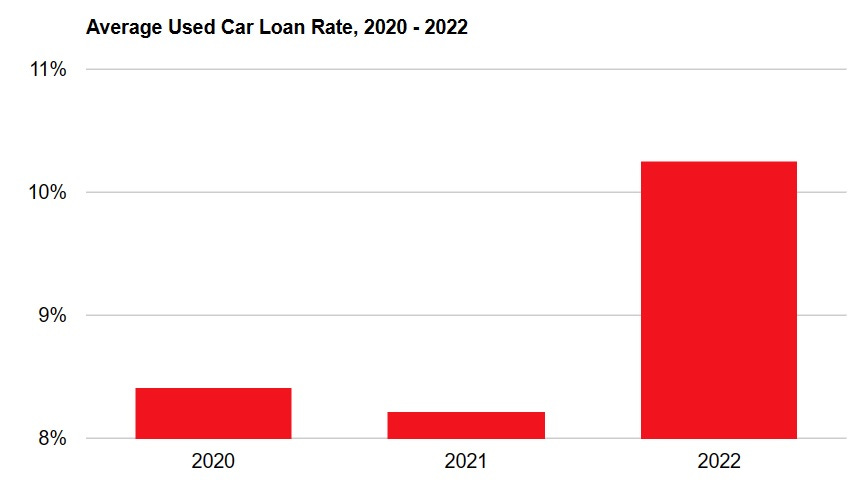

Autos are a bursting bubble

The number of underwater car loans, where the loan balance exceeds the value of the car, has been rising for months. Interest rates on used car loans had jumped from an average of 8% to over 10% in the past year. And auto loan delinquency rates have climbed to their highest levels in over 15 years, with an especially big jump among subprime borrowers. Now panicked banks will make car loans even harder to get while a growing number of borrowers will default on their existing loans. Typical recession behavior, but this time against a crisis backdrop.

Commercial real estate was toast in any event, but now it’s burnt toast

Office buildings, warehouses and such never fully recovered from the pandemic lockdowns, and by the 4th quarter of 2022 delinquencies on commercial real estate loans were rising sharply. Building prices were beginning to fall, and the specter of a commercial real estate crash was looming. And that was before banks and regulators went into their current panic mode. Now just try refinancing an underperforming office complex and see how it goes.

And there’s more…

Stephanie Pomboy, an analyst whose work has been spot-on lately, tweeted this 12 hours ago:

In other words, a lot can still go wrong, because excessive leverage is hidden all over the place. A pension bust would mean a multi-trillion dollar bailout, for instance, and that was probably coming even in “normal” times. As for derivatives, well, they’ll destroy the world eventually, so why not now?ya know what’s keeping me up at night? Thinking about the unseen exposure by NONbank finl institutions to things far riskier than the stuff bringing down the banks. Esp, the prospect that some insurer (&counterparty in the giant mkt of credit derivatives) is about to go toes up

And don’t even get me started on pensions. I’ve ranted breathlessly on that. They will be the subject of a bailout the likes of which we have never before witnessed. If you think the bank bailout is gonna be massive…stay tuned. You ain’t seen nothing.

The take-away? In the midst of all the various credit crises, controlling inflation will be moved to the back burner. And the world will realize that the central banks are out of ammo, with no choice but to let their currencies burn.

Read the full article at John Rubino.

John Rubino is a former Wall Street financial analyst and author or co-author of five books, including The Money Bubble: What To Do Before It Pops and Clean Money: Picking Winners in the Green-Tech Boom. He founded the popular financial website DollarCollapse.com in 2004 and sold it in 2022.

Comment on this article at Health Impact News.

THANKS TO: https://medicalkidnap.com/2023/03/21/central-banks-are-out-of-ammo-with-no-choice-but-to-let-their-currencies-burn/

Sat Mar 23, 2024 11:33 pm by globalturbo

Sat Mar 23, 2024 11:33 pm by globalturbo