“It’s Spooky”: Stanford Professor Warns Thousands Of US Banks Are “Potentially Insolvent”

Tyler Durden

May 6, 2023

By Tyler Durden

Following the collapse of First Republic last week, the meltdown of three other banks, and the Federal Reserve’s quarter-point increase, making the tenth straight hike in an aggressive campaign to tame elevated inflation, a professor of finance at the Stanford Graduate School of Business presented a grim warning that the regional banking dominoes are falling.

In a New York Times opinion piece titled “Yes, You Should Be Worried About a Potential Bank Crisis. Here’s Why,” Professor Amit Seru wrote, “the fragility and collapse of several high-profile banks are most likely not an isolated phenomenon.” He said, “A damaging combination of fast-rising interest rates, major changes in work patterns, and the potential of a recession could prompt a credit crunch not seen since the 2008 financial crisis.”

In an interview with The Guardian, Seru was more precise about just how many banks were burning through their capital buffers and were underwater. The estimate is shocking: Almost half of America’s 4,800 banks.

In Seru’s NYTimes op-ed piece, he noted, “There’s another looming area of concern that could spark such panic: The commercial real estate sector.”

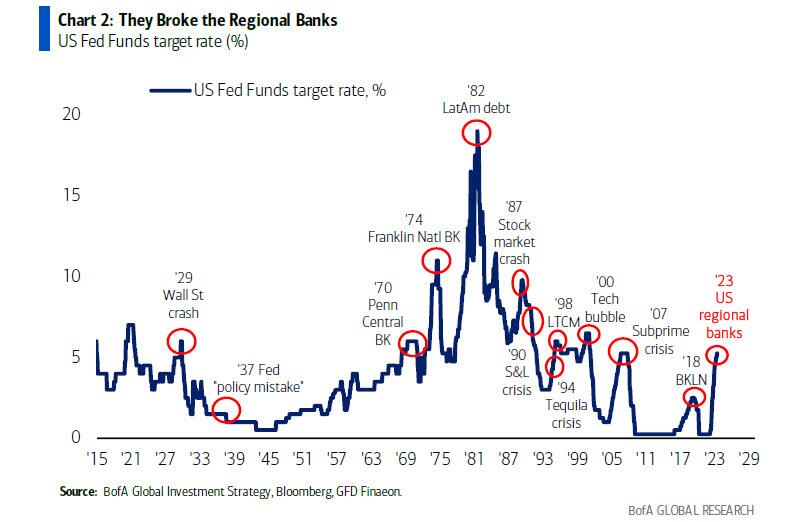

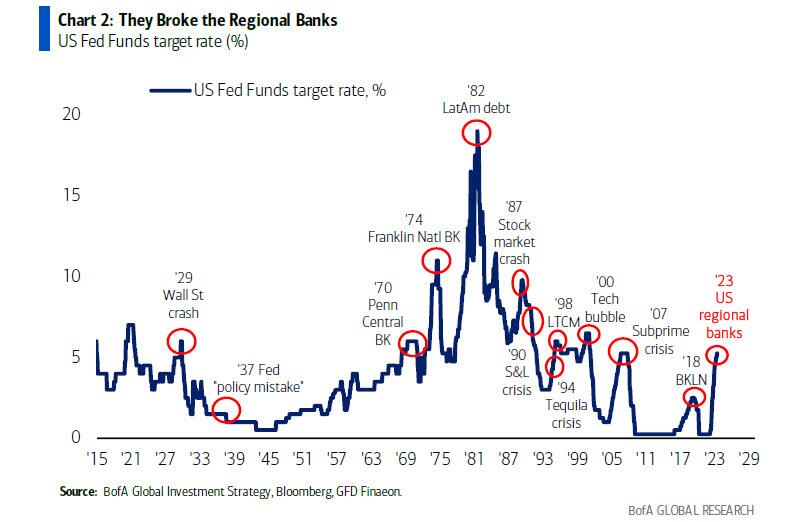

Our latest note, featuring BofA strategist Michael Hartnett highlights “every Fed tightening cycle ends in crisis.”

The apocalyptic warning about a vast number of US banks being insolvent comes as JPMorgan CEO Jamie Dimon’s recently claimed: “The system is very, very sound.”

Source: ZeroHedge

THANKS TO: https://www.activistpost.com/2023/05/its-spooky-stanford-professor-warns-thousands-of-us-banks-are-potentially-insolvent.html

Tyler Durden

May 6, 2023

By Tyler Durden

Following the collapse of First Republic last week, the meltdown of three other banks, and the Federal Reserve’s quarter-point increase, making the tenth straight hike in an aggressive campaign to tame elevated inflation, a professor of finance at the Stanford Graduate School of Business presented a grim warning that the regional banking dominoes are falling.

In a New York Times opinion piece titled “Yes, You Should Be Worried About a Potential Bank Crisis. Here’s Why,” Professor Amit Seru wrote, “the fragility and collapse of several high-profile banks are most likely not an isolated phenomenon.” He said, “A damaging combination of fast-rising interest rates, major changes in work patterns, and the potential of a recession could prompt a credit crunch not seen since the 2008 financial crisis.”

Just in the past few months, Silicon Valley Bank, Signature Bank and First Republic Bank have failed. Their combined assets surpassed those held by the 25 banks (when adjusted for inflation) that collapsed at the height of the financial crisis. While some experts and policymakers believe that the resolution of First Republic Bank on Monday indicates the turbulence in the industry is coming to an end, I believe this may be premature. On Thursday, shares of PacWest and Western Alliance are falling as investors’ fears spread. Adverse conditions have significantly weakened the ability of many banks to withstand another credit shock — and it’s clear that a big one may already be on its way.

Rapidly rising interest rates create perilous conditions for banks because of a basic principle: The longer the duration of an investment, the more sensitive it is to changes in interest rates. When interest rates rise, the assets that banks hold to generate a return on their investment fall in value. And because the banks’ liabilities — like its deposits, which customers can withdraw at any time — usually are shorter in duration, they fall by less. Thus, increases in interest rates can deplete a bank’s equity and risk leaving it with more liabilities than assets. So it’s no surprise that the US banking system’s market value of assets is around $2 trillion lower than suggested by their book value. When the entire set of approximately 4,800 banks in the United States is examined, the decline in the value of equity is most prominent for midsize and smaller banks, reflecting their heavier bets on long-term assets.

In an interview with The Guardian, Seru was more precise about just how many banks were burning through their capital buffers and were underwater. The estimate is shocking: Almost half of America’s 4,800 banks.

Since monetary tightening works in long lags (9-12 months), many of the rate hikes over the last year have yet to filter through the real economy. In the coming quarters, the US banking system will face its toughest challenge yet, as tightening lending standards might spark more breaking.“It’s spooky. Thousands of banks are underwater.

“Let’s not pretend that this is just about Silicon Valley Bank and First Republic. A lot of the US banking system is potentially insolvent.”

In Seru’s NYTimes op-ed piece, he noted, “There’s another looming area of concern that could spark such panic: The commercial real estate sector.”

For Zerohedge readers, the dual crises affecting regional banks and the commercial real estate sector (offices) isn’t a new thesis. We first proposed the coming turmoil on Mar. 21 in a note titled “‘Nowhere To Hide In CMBS’: CRE Nuke Goes Off With Small Banks Accounting For 70% Of Commercial Real Estate Loans”. We’ve documented the unfolding crisis spreading from regional banks to the CRE space in numerous pieces (many of which can be found in our premium section).Commercial real estate loans, worth $2.7 trillion in the United States, make up around a quarter of an average bank’s assets. Many of these loans are coming due in the next few years, and refinancing them at higher rates naturally increases the risk of default. Rising interest rates also depress the value of commercial properties, especially those with long-term leases and limited rent escalation clauses, which also increases the likelihood of owner default. In the Great Recession, for example, default rates rose to about 9 percent, up from around 1 percent, as interest rates rose.

Our latest note, featuring BofA strategist Michael Hartnett highlights “every Fed tightening cycle ends in crisis.”

The apocalyptic warning about a vast number of US banks being insolvent comes as JPMorgan CEO Jamie Dimon’s recently claimed: “The system is very, very sound.”

Source: ZeroHedge

THANKS TO: https://www.activistpost.com/2023/05/its-spooky-stanford-professor-warns-thousands-of-us-banks-are-potentially-insolvent.html

Sat Mar 23, 2024 11:33 pm by globalturbo

Sat Mar 23, 2024 11:33 pm by globalturbo