Debt Trap and Beyond

July 24, 2023 Winter Watch

The fiscal debt tidal wave at this point in time tacked on an extra $ half trillion in interest payment expense from two years ago.

The trend is parabolic. Unlike most European countries the US funded the scamdemic free for all with ultra low interest treasury bills maturing in less than two years. As the chart below shows 43% of the “Treasury” will need to be refinanced over the next two years. That is over $14 trillion.

To illustrate the impact of this today, I just had a six month t-bill yielding 4.86% mature which I replaced through Treasury Direct at 5.49%. One year treasuries too are at this level. Given these levels readers should ask if they should keep extra funds in lower yielding bank deposits or even money markets. Almost all large brokerage firms offer easy to use Treasury Direct accounts. I am sure a representative could walk you through the process.

Certainly there is a little room for the Treasury to fund it’s shitstorm via drawing funds from non-competitive bank deposits. This however has been moving at a glacial pace.

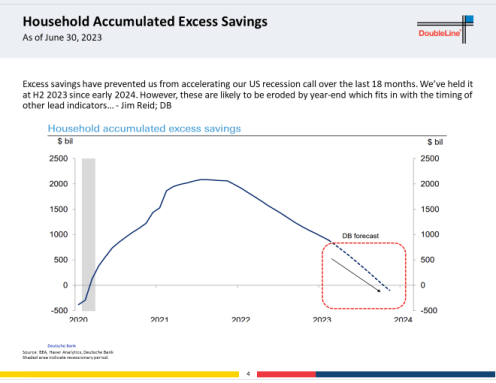

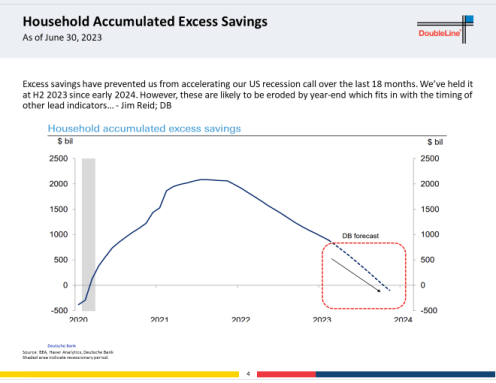

The excess household savings that piled up from the scamdemic largess is gone, so the twin deficits won’t be financed from this source.

Foreigners can’t keep pace with the debt and rollover blitz. Foreign holders held $7.53 trillion in Treasuries in May.

The Federal Reserve is attempting to reduce it’s holdings. Unless it aggressively reverses course it is MIA. The Fed has large operational losses from the near zero return sludge it bought during the scamdemic debt deluge.

The Treasury Department said that the budget gap from October through June was nearly $1.4 trillion — a 170% increase from the same period a year earlier. The federal government operates under a fiscal year that begins October 1. Overall, tax revenues between October and June were 11% lower than the same period a year ago. At the same time, government spending jumped 10%.

The twin deficits (fiscal and trade) are running at 16% of GDP. This will need to be financed. I would submit the real reason for rising interest rates is an attempt to attract bids for this fresh debt as well as the rollover of prior debt.

The US runs a criminally bogus AAA credit rating through it’s capture of the major credit agencies and the malfeasance of Wall Street.

Debt-to-Income Ratios (DTIs) for new homebuyers are now approaching 40% in the beginning of 2023. That means new homebuyers are now spending 40% of their gross income on mortgage and interest costs. Same level as 2006.

THANKS TO: https://www.winterwatch.net/2023/07/debt-trap-and-beyond/

July 24, 2023 Winter Watch

The fiscal debt tidal wave at this point in time tacked on an extra $ half trillion in interest payment expense from two years ago.

The trend is parabolic. Unlike most European countries the US funded the scamdemic free for all with ultra low interest treasury bills maturing in less than two years. As the chart below shows 43% of the “Treasury” will need to be refinanced over the next two years. That is over $14 trillion.

To illustrate the impact of this today, I just had a six month t-bill yielding 4.86% mature which I replaced through Treasury Direct at 5.49%. One year treasuries too are at this level. Given these levels readers should ask if they should keep extra funds in lower yielding bank deposits or even money markets. Almost all large brokerage firms offer easy to use Treasury Direct accounts. I am sure a representative could walk you through the process.

Certainly there is a little room for the Treasury to fund it’s shitstorm via drawing funds from non-competitive bank deposits. This however has been moving at a glacial pace.

The excess household savings that piled up from the scamdemic largess is gone, so the twin deficits won’t be financed from this source.

Foreigners can’t keep pace with the debt and rollover blitz. Foreign holders held $7.53 trillion in Treasuries in May.

The Federal Reserve is attempting to reduce it’s holdings. Unless it aggressively reverses course it is MIA. The Fed has large operational losses from the near zero return sludge it bought during the scamdemic debt deluge.

The Treasury Department said that the budget gap from October through June was nearly $1.4 trillion — a 170% increase from the same period a year earlier. The federal government operates under a fiscal year that begins October 1. Overall, tax revenues between October and June were 11% lower than the same period a year ago. At the same time, government spending jumped 10%.

The twin deficits (fiscal and trade) are running at 16% of GDP. This will need to be financed. I would submit the real reason for rising interest rates is an attempt to attract bids for this fresh debt as well as the rollover of prior debt.

The US runs a criminally bogus AAA credit rating through it’s capture of the major credit agencies and the malfeasance of Wall Street.

Debt-to-Income Ratios (DTIs) for new homebuyers are now approaching 40% in the beginning of 2023. That means new homebuyers are now spending 40% of their gross income on mortgage and interest costs. Same level as 2006.

THANKS TO: https://www.winterwatch.net/2023/07/debt-trap-and-beyond/

Sat Mar 23, 2024 11:33 pm by globalturbo

Sat Mar 23, 2024 11:33 pm by globalturbo