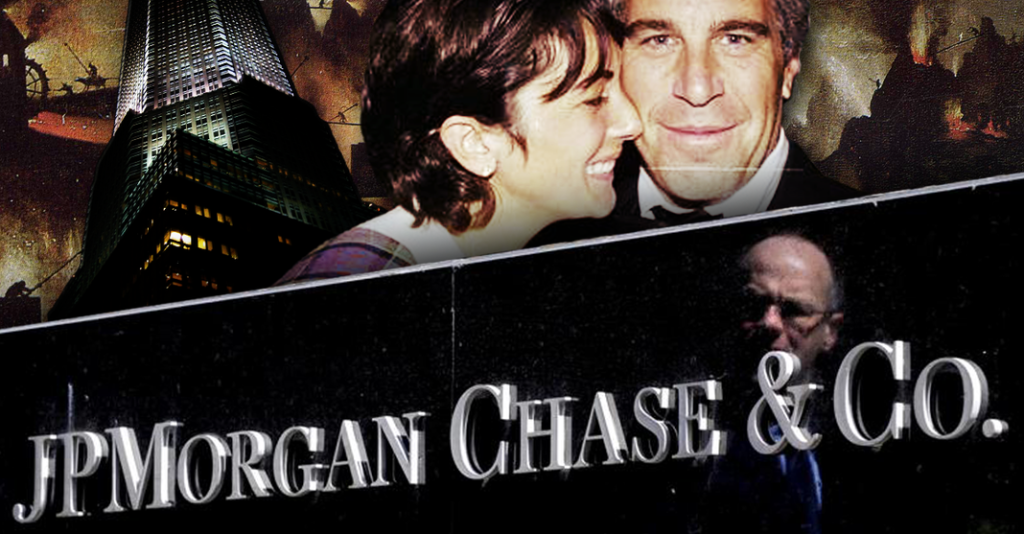

HIGH CRIMES: Court Filing – JPMorgan Chase “Actively Participated in Epstein’s Sex-Trafficking Venture”

SM

Source -wallstreetonparade.com

Jamie Dimon Sits in Front of Trading Monitor in his Office (Source: 60 Minutes Interview, November 10, 2019)

The Attorney General of the U.S. Virgin Islands, armed with highly effective legal talent from the law firm, MotleyRice – which stakes its reputation on its “boldness” – has filed new documents in its federal lawsuit against the largest bank in the United States, JPMorgan Chase. The new documents are, indeed, breathtakingly bold.

The U.S. Virgin Islands’ attorneys have clarified to the court that they plan to show in a trial scheduled for October that JPMorgan Chase not only facilitated the sex trafficking of underage girls by Jeffrey Epstein but that the bank “actively participated in Epstein’s sex-trafficking venture from 2006 until 2019.”

That is a very explosive assertion. For starters, it throws up a giant red flare as to why the American public has heard nothing from the criminal division of the U.S. Department of Justice about a criminal case against the bank for laundering money for Epstein. The case brought by the U.S. Virgin Islands is a civil case.

The U.S. Virgin Islands filed hundreds of pages of new court documents on Monday and Tuesday. Most of the exhibits have been filed under seal. A Memorandum of Law arguing for partial summary judgment in the case, however, is only lightly redacted and makes the following points:

“Even if participation requires active engagement…there is no genuine dispute that JPMorgan actively participated in Epstein’s sex-trafficking venture from 2006 until 2019. The Court found allegations that the Bank allowed Epstein to use its accounts to send dozens of payments to then-known co-conspirators [redacted] provided excessive and unusual amounts of cash to Epstein; and structured cash withdrawals so that those withdrawals would not appear suspicious ‘went well beyond merely providing their usual [banking] services to Jeffrey Epstein and his affiliated entities’ and were sufficient to allege active engagement.”

The U.S. Virgin Islands has previously alerted the court to the unfathomable sums of hard cash that Epstein was able to take from the accounts he maintained at JPMorgan Chase without the bank filing the legally mandated Suspicious Activity Reports (SARs) to law enforcement. In the new filing, it has tallied up the giant pile of cash, writing as follows:

“Between September 2003 and November 2013, or approximately ten years, JPMorgan handled more than $5 million in outgoing cash transactions for Epstein — ignoring its own policy discouraging large cash withdrawals….”

The U.S. Virgin Islands’ attorneys cite to internal emails at JPMorgan Chase showing that employees at the bank were aware of Epstein’s “[c]ash withdrawals … made in amounts for $40,000 to $80,000 several times a month” while also being aware that Epstein paid his underage sexual assault victims in cash.

JPMorgan Chase’s active participation in the Epstein sex trafficking ring was also alleged in a separate class action lawsuit against JPMorgan Chase brought by lawyers David Boies and Bradley Edwards on behalf of Epstein’s victims. At a March 13 court hearing in the case, Boies argued in open court that JPMorgan Chase had used a private jet owned by the bank’s hedge fund, Highbridge Capital, to transport girls for Epstein’s sex trafficking operation. A January 13, 2023 amended complaint filed by Boies’ law firm provided the following details on that allegation:

“As another example of JP Morgan and [Jes] Staley’s benefit from assisting Epstein, a highly profitable deal for JP Morgan was the Highbridge acquisition.

“In 2004, when Epstein’s sex trafficking and abuse operation was running at full speed, Epstein served up another big financial payday for JP Morgan.

“Epstein was close friends with Glenn Dubin, the billionaire who ran Highbridge Capital Management.

“Through Epstein’s connection, it has been reported that Staley arranged for JP Morgan to buy a majority stake in Dubin’s fund, which resulted in a sizeable profit for JP Morgan. This arrangement was profitable for both Staley and JPMorgan, further incentivizing JP Morgan to ignore the suspicious activity in Epstein’s accounts and to assist in his sex-trafficking venture.

“For example, despite that Epstein was not FINRA-certified, Epstein was paid more than $15 million for his role in the Highbridge/JP Morgan deal.

“Moreover, Highbridge, a wholly-owned subsidiary of JP Morgan, trafficked young women and girls on its own private jet from Florida to Epstein in New York as late as 2012.”

With the criminal division of the U.S. Department of Justice sitting on its hands in this matter, and the Boies/Edwards lawsuit on behalf of victims now settled for $290 million by JPMorgan Chase – with victims’ lawyers getting $87 million in legal fees and $2.5 million in expenses while victims are guaranteed nothing other than a requirement to release their claims – there is no assurance that the American people will ever hear the hard facts about sex trafficking via a corporate jet owned by the largest bank in the United States.

Thus, it is becoming critically important that the U.S. Virgin Islands actually bring its case to trial in a public courtroom and not fold like another cheap suit by accepting a pile of tainted money from JPMorgan Chase. If the U.S. Virgin Islands wants to make good on its promise to serve the public interest, its hundreds of sealed documents need to get unsealed during the trial instead of serving as an incentive on the court docket for JPMorgan Chase to pay up to keep the documents sealed.

In its latest filings, the U.S. Virgin Islands also note that JPMorgan Chase didn’t just bank Epstein’s accounts but it also banked “all the girls and women publicly alleged in 2006 to be recruiters, accomplices, or victims…” and regularly transferred monies into these accounts from Epstein to buy everyone’s silence. In the case of Epstein’s accomplice-in-chief, Ghislaine Maxwell, who is now serving a 20-year prison sentence for her role in the sex trafficking ring, the new filing notes that JPMorgan Chase “made over $25 million in payments to Maxwell from Epstein….”

What was the bank getting out of all of its sleazy dealings with Epstein? The U.S. Virgin Islands makes a very credible case that the bank was getting lots of profits – both from trading in Epstein’s own accounts as well as his referrals of rich clients to the bank. The Memorandum of Law filed on Monday notes that Epstein “was “bringing in over $8 million in revenues to the Private Bank — the top revenue and nearly double the amount of the next highest client….”

As for the client referrals that Epstein made to the bank, the U.S. Virgin Islands writes as follows:

“In 2003, Epstein was, by double, the top revenue generator in the Private Bank, and the source of Google co-founder Sergey Brin (‘one of the largest [relationships] in the Private Bank, of +$4BN’), Glenn Dubin (billionaire founder of Highbridge), and many other ultra-wealthy clients and connections, which would come to include Bill Gates, Leon Black, Larry Summers, the Sultan of Dubai, Prince Andrew, Ehud Barak, Thomas Pritzker, Lord Peter Mandelson, and Prime Minister Netanyahu.”

Among that client referral list above, Leon Black, the co-founder and former CEO of private equity firm Apollo Global Management, is facing a current lawsuit in federal court over allegations he violently raped one of Epstein’s victims in Epstein’s upper East Side mansion in Manhattan when she was 16. The alleged victim suffers from mosaic Down Syndrome according to the lawsuit. This is only the latest in multiple charges of sexual assault that have been lodged against Black. (But, once again, the silence from the criminal division of the U.S. Department of Justice is deafening.)

Reporter Matt Goldstein broke the story last Friday in the New York Times that Leon Black had quietly settled charges with the U.S. Virgin Islands earlier this year with a payment of $62.5 million.

Another rich, powerful man on Epstein’s client referral list to JPMorgan Chase is Prince Andrew, who settled claims last year of sexually assaulting Epstein’s sex slave, Virginia Giuffre, when she was 17 and loaned out to him by Epstein. The monetary details were not disclosed. In a BBC interview in 2022, Giuffre said she was “passed around like a platter of fruit” for sex with Epstein’s powerful friends.

Wall Street On Parade has been reporting for years on how the systemic culture of JPMorgan Chase is to ignore the law in pursuit of profits. One striking example was investigated by the U.S. Senate’s Permanent Subcommittee on Investigations. The Subcommittee got its hands on internal emails at JPMorgan Chase showing that when a young recent graduate of a law school submitted his resume to the bank, and bragged about finding a loophole that could be gamed by the bank to extract obscene profits from the California electric market, an executive at the bank wrote: “Please get him in ASAP.”

The bank hired the young recruit and deployed the strategy. The bank was eventually fined $410 million in penalties and disgorgements by the Federal Energy Regulatory Commission (FERC).

It was also revealed during the Senate hearing into the matter that while JPMorgan was being investigated, it continued to engage in other manipulative electricity schemes, a total of 11 in all. The Senate report noted that FERC officials told the Subcommittee “that in the years since Congress gave FERC enhanced anti-manipulation authority in the Energy Policy Act of 2005, the CAISO and MISO regulators had never before witnessed the degree of blatant rule manipulation and gaming strategies that JPMorgan used to win electricity awards and elicit make-whole payments.” (See our report: JPMorgan Rushed to Hire Trader Who Suggested on His Resume That He Knew How to Game Electric Markets.)

Gaming electric markets is, of course, a trivial matter for a bank that has admitted to five criminal felony counts since 2014, which includes laundering money for the largest Ponzi scheme in U.S. history (Bernie Madoff) and rigging the market for U.S. Treasuries – the market that the U.S. government uses to pay its bills.

Throughout this unprecedented crime spree and non-prosecution agreements and deferred-prosecution agreements generously lavished on JPMorgan Chase by the bizarrely forgiving U.S. Department of “Justice,” the Board of Directors of the bank has kept Jamie Dimon in place as both Chairman and CEO. For the conflicts of interest between the bank and its Board that might explain that lack of action, see our report here.

Now Dimon and specific members of the Board of Directors also find themselves being sued directly for their role in facilitating Jeffrey Epstein’s crimes. The lawsuit has been brought by two pension funds on behalf of shareholders. The lawsuit’s theory of the case is that specific members of the Board of JPMorgan Chase “put their heads in the sand” and ignored that the bank had become a cash conduit for Jeffrey Epstein’s child sex trafficking ring because they were hoping that their own business ties to Epstein “would go unnoticed.”

The pension fund case, the Epstein victims’ case that was settled last month for $290 million, and the U.S. Virgin Islands’ case, are all before the same judge, Jed Rakoff, in the U.S. District Court for the Southern District of New York – a District Court where Big Law is known for getting sweet deals for Wall Street’s recidivist miscreants.

Representing the Board Members who have been named in the latest lawsuit brought by the pension funds is Big Law firm, Paul, Weiss, Rifkind, Wharton & Garrison. For background on how Paul Weiss services Wall Street, see our report: Meet the Lawyer Who Gets Citigroup Out of Fraud Charges and The Untold Story of the Paul Weiss Internal Investigation that Didn’t Catch a Massive Stock Fraud and Judge Issues Scathing Rebuke of DOJ and Law Firm, Paul Weiss

THANKS TO: https://rielpolitik.com/2023/08/03/high-crimes-court-filing-jpmorgan-chase-actively-participated-in-epsteins-sex-trafficking-venture/

SM

Source -wallstreetonparade.com

- “…JPMorgan Chase didn’t just bank Epstein’s accounts but it also banked “all the girls and women publicly alleged in 2006 to be recruiters, accomplices, or victims…” and regularly transferred monies into these accounts from Epstein to buy everyone’s silence. In the case of Epstein’s accomplice-in-chief, Ghislaine Maxwell, who is now serving a 20-year prison sentence for her role in the sex trafficking ring, the new filing notes that JPMorgan Chase “made over $25 million in payments to Maxwell from Epstein….”

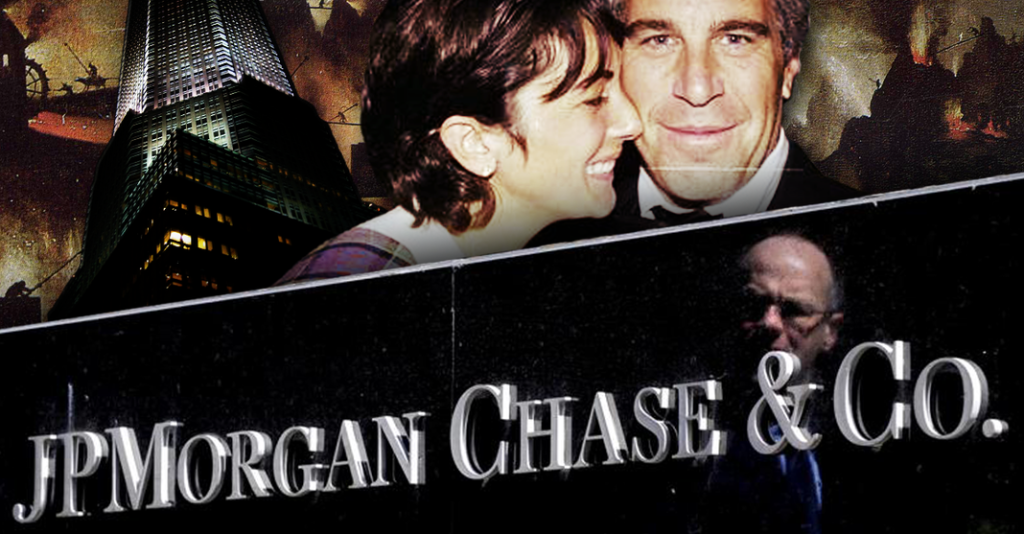

Court Filing: JPMorgan Chase “Actively Participated in Epstein’s Sex-Trafficking Venture”

By Pam Martens and Russ Martens

Jamie Dimon Sits in Front of Trading Monitor in his Office (Source: 60 Minutes Interview, November 10, 2019)

The Attorney General of the U.S. Virgin Islands, armed with highly effective legal talent from the law firm, MotleyRice – which stakes its reputation on its “boldness” – has filed new documents in its federal lawsuit against the largest bank in the United States, JPMorgan Chase. The new documents are, indeed, breathtakingly bold.

The U.S. Virgin Islands’ attorneys have clarified to the court that they plan to show in a trial scheduled for October that JPMorgan Chase not only facilitated the sex trafficking of underage girls by Jeffrey Epstein but that the bank “actively participated in Epstein’s sex-trafficking venture from 2006 until 2019.”

That is a very explosive assertion. For starters, it throws up a giant red flare as to why the American public has heard nothing from the criminal division of the U.S. Department of Justice about a criminal case against the bank for laundering money for Epstein. The case brought by the U.S. Virgin Islands is a civil case.

The U.S. Virgin Islands filed hundreds of pages of new court documents on Monday and Tuesday. Most of the exhibits have been filed under seal. A Memorandum of Law arguing for partial summary judgment in the case, however, is only lightly redacted and makes the following points:

“Even if participation requires active engagement…there is no genuine dispute that JPMorgan actively participated in Epstein’s sex-trafficking venture from 2006 until 2019. The Court found allegations that the Bank allowed Epstein to use its accounts to send dozens of payments to then-known co-conspirators [redacted] provided excessive and unusual amounts of cash to Epstein; and structured cash withdrawals so that those withdrawals would not appear suspicious ‘went well beyond merely providing their usual [banking] services to Jeffrey Epstein and his affiliated entities’ and were sufficient to allege active engagement.”

The U.S. Virgin Islands has previously alerted the court to the unfathomable sums of hard cash that Epstein was able to take from the accounts he maintained at JPMorgan Chase without the bank filing the legally mandated Suspicious Activity Reports (SARs) to law enforcement. In the new filing, it has tallied up the giant pile of cash, writing as follows:

“Between September 2003 and November 2013, or approximately ten years, JPMorgan handled more than $5 million in outgoing cash transactions for Epstein — ignoring its own policy discouraging large cash withdrawals….”

The U.S. Virgin Islands’ attorneys cite to internal emails at JPMorgan Chase showing that employees at the bank were aware of Epstein’s “[c]ash withdrawals … made in amounts for $40,000 to $80,000 several times a month” while also being aware that Epstein paid his underage sexual assault victims in cash.

JPMorgan Chase’s active participation in the Epstein sex trafficking ring was also alleged in a separate class action lawsuit against JPMorgan Chase brought by lawyers David Boies and Bradley Edwards on behalf of Epstein’s victims. At a March 13 court hearing in the case, Boies argued in open court that JPMorgan Chase had used a private jet owned by the bank’s hedge fund, Highbridge Capital, to transport girls for Epstein’s sex trafficking operation. A January 13, 2023 amended complaint filed by Boies’ law firm provided the following details on that allegation:

“As another example of JP Morgan and [Jes] Staley’s benefit from assisting Epstein, a highly profitable deal for JP Morgan was the Highbridge acquisition.

“In 2004, when Epstein’s sex trafficking and abuse operation was running at full speed, Epstein served up another big financial payday for JP Morgan.

“Epstein was close friends with Glenn Dubin, the billionaire who ran Highbridge Capital Management.

“Through Epstein’s connection, it has been reported that Staley arranged for JP Morgan to buy a majority stake in Dubin’s fund, which resulted in a sizeable profit for JP Morgan. This arrangement was profitable for both Staley and JPMorgan, further incentivizing JP Morgan to ignore the suspicious activity in Epstein’s accounts and to assist in his sex-trafficking venture.

“For example, despite that Epstein was not FINRA-certified, Epstein was paid more than $15 million for his role in the Highbridge/JP Morgan deal.

“Moreover, Highbridge, a wholly-owned subsidiary of JP Morgan, trafficked young women and girls on its own private jet from Florida to Epstein in New York as late as 2012.”

With the criminal division of the U.S. Department of Justice sitting on its hands in this matter, and the Boies/Edwards lawsuit on behalf of victims now settled for $290 million by JPMorgan Chase – with victims’ lawyers getting $87 million in legal fees and $2.5 million in expenses while victims are guaranteed nothing other than a requirement to release their claims – there is no assurance that the American people will ever hear the hard facts about sex trafficking via a corporate jet owned by the largest bank in the United States.

Thus, it is becoming critically important that the U.S. Virgin Islands actually bring its case to trial in a public courtroom and not fold like another cheap suit by accepting a pile of tainted money from JPMorgan Chase. If the U.S. Virgin Islands wants to make good on its promise to serve the public interest, its hundreds of sealed documents need to get unsealed during the trial instead of serving as an incentive on the court docket for JPMorgan Chase to pay up to keep the documents sealed.

In its latest filings, the U.S. Virgin Islands also note that JPMorgan Chase didn’t just bank Epstein’s accounts but it also banked “all the girls and women publicly alleged in 2006 to be recruiters, accomplices, or victims…” and regularly transferred monies into these accounts from Epstein to buy everyone’s silence. In the case of Epstein’s accomplice-in-chief, Ghislaine Maxwell, who is now serving a 20-year prison sentence for her role in the sex trafficking ring, the new filing notes that JPMorgan Chase “made over $25 million in payments to Maxwell from Epstein….”

What was the bank getting out of all of its sleazy dealings with Epstein? The U.S. Virgin Islands makes a very credible case that the bank was getting lots of profits – both from trading in Epstein’s own accounts as well as his referrals of rich clients to the bank. The Memorandum of Law filed on Monday notes that Epstein “was “bringing in over $8 million in revenues to the Private Bank — the top revenue and nearly double the amount of the next highest client….”

As for the client referrals that Epstein made to the bank, the U.S. Virgin Islands writes as follows:

“In 2003, Epstein was, by double, the top revenue generator in the Private Bank, and the source of Google co-founder Sergey Brin (‘one of the largest [relationships] in the Private Bank, of +$4BN’), Glenn Dubin (billionaire founder of Highbridge), and many other ultra-wealthy clients and connections, which would come to include Bill Gates, Leon Black, Larry Summers, the Sultan of Dubai, Prince Andrew, Ehud Barak, Thomas Pritzker, Lord Peter Mandelson, and Prime Minister Netanyahu.”

Among that client referral list above, Leon Black, the co-founder and former CEO of private equity firm Apollo Global Management, is facing a current lawsuit in federal court over allegations he violently raped one of Epstein’s victims in Epstein’s upper East Side mansion in Manhattan when she was 16. The alleged victim suffers from mosaic Down Syndrome according to the lawsuit. This is only the latest in multiple charges of sexual assault that have been lodged against Black. (But, once again, the silence from the criminal division of the U.S. Department of Justice is deafening.)

Reporter Matt Goldstein broke the story last Friday in the New York Times that Leon Black had quietly settled charges with the U.S. Virgin Islands earlier this year with a payment of $62.5 million.

Another rich, powerful man on Epstein’s client referral list to JPMorgan Chase is Prince Andrew, who settled claims last year of sexually assaulting Epstein’s sex slave, Virginia Giuffre, when she was 17 and loaned out to him by Epstein. The monetary details were not disclosed. In a BBC interview in 2022, Giuffre said she was “passed around like a platter of fruit” for sex with Epstein’s powerful friends.

Wall Street On Parade has been reporting for years on how the systemic culture of JPMorgan Chase is to ignore the law in pursuit of profits. One striking example was investigated by the U.S. Senate’s Permanent Subcommittee on Investigations. The Subcommittee got its hands on internal emails at JPMorgan Chase showing that when a young recent graduate of a law school submitted his resume to the bank, and bragged about finding a loophole that could be gamed by the bank to extract obscene profits from the California electric market, an executive at the bank wrote: “Please get him in ASAP.”

The bank hired the young recruit and deployed the strategy. The bank was eventually fined $410 million in penalties and disgorgements by the Federal Energy Regulatory Commission (FERC).

It was also revealed during the Senate hearing into the matter that while JPMorgan was being investigated, it continued to engage in other manipulative electricity schemes, a total of 11 in all. The Senate report noted that FERC officials told the Subcommittee “that in the years since Congress gave FERC enhanced anti-manipulation authority in the Energy Policy Act of 2005, the CAISO and MISO regulators had never before witnessed the degree of blatant rule manipulation and gaming strategies that JPMorgan used to win electricity awards and elicit make-whole payments.” (See our report: JPMorgan Rushed to Hire Trader Who Suggested on His Resume That He Knew How to Game Electric Markets.)

Gaming electric markets is, of course, a trivial matter for a bank that has admitted to five criminal felony counts since 2014, which includes laundering money for the largest Ponzi scheme in U.S. history (Bernie Madoff) and rigging the market for U.S. Treasuries – the market that the U.S. government uses to pay its bills.

Throughout this unprecedented crime spree and non-prosecution agreements and deferred-prosecution agreements generously lavished on JPMorgan Chase by the bizarrely forgiving U.S. Department of “Justice,” the Board of Directors of the bank has kept Jamie Dimon in place as both Chairman and CEO. For the conflicts of interest between the bank and its Board that might explain that lack of action, see our report here.

Now Dimon and specific members of the Board of Directors also find themselves being sued directly for their role in facilitating Jeffrey Epstein’s crimes. The lawsuit has been brought by two pension funds on behalf of shareholders. The lawsuit’s theory of the case is that specific members of the Board of JPMorgan Chase “put their heads in the sand” and ignored that the bank had become a cash conduit for Jeffrey Epstein’s child sex trafficking ring because they were hoping that their own business ties to Epstein “would go unnoticed.”

The pension fund case, the Epstein victims’ case that was settled last month for $290 million, and the U.S. Virgin Islands’ case, are all before the same judge, Jed Rakoff, in the U.S. District Court for the Southern District of New York – a District Court where Big Law is known for getting sweet deals for Wall Street’s recidivist miscreants.

Representing the Board Members who have been named in the latest lawsuit brought by the pension funds is Big Law firm, Paul, Weiss, Rifkind, Wharton & Garrison. For background on how Paul Weiss services Wall Street, see our report: Meet the Lawyer Who Gets Citigroup Out of Fraud Charges and The Untold Story of the Paul Weiss Internal Investigation that Didn’t Catch a Massive Stock Fraud and Judge Issues Scathing Rebuke of DOJ and Law Firm, Paul Weiss

THANKS TO: https://rielpolitik.com/2023/08/03/high-crimes-court-filing-jpmorgan-chase-actively-participated-in-epsteins-sex-trafficking-venture/

Sat Mar 23, 2024 11:33 pm by globalturbo

Sat Mar 23, 2024 11:33 pm by globalturbo